Strategic Planning

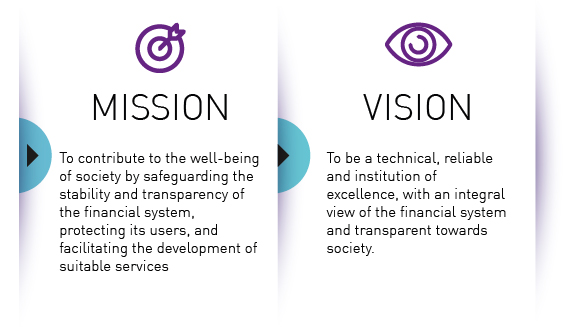

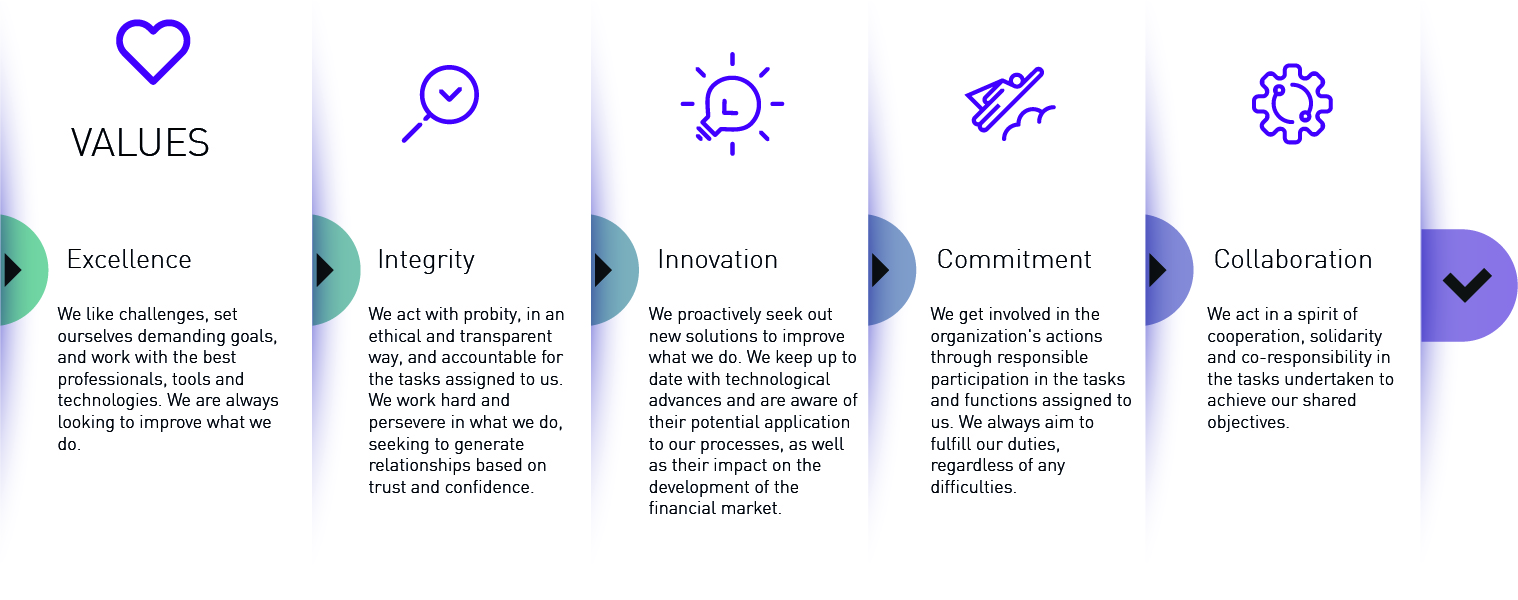

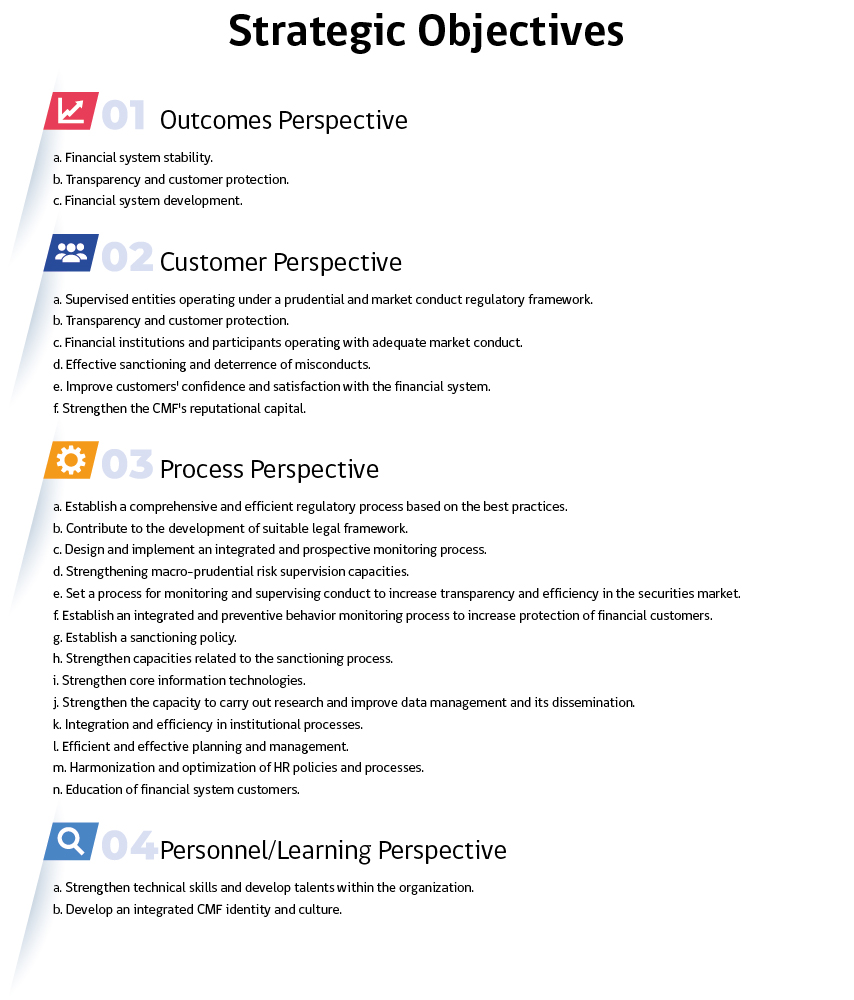

The Financial Market Commission presents its 2020-22 Strategic Plan. Said Plan is the roadmap for the years 2020-22 and establishes the new Mission, Vision, and Strategic Goals that will guide its institutional work.

The Financial Market Commission presents its 2020-22 Strategic Plan. Said Plan is the roadmap for the years 2020-22 and establishes the new Mission, Vision, and Strategic Goals that will guide its institutional work.

Av. Libertador Bernardo O'Higgins 1449, Santiago, Chile

Horario de atención: lunes a viernes de 9:00 a 13:30 horas.

Código Postal 834-0518

Call center institucional:

(56 2) 2617 4000

-

(56 2) 2887 9200

RUT: 60.810.000-8

Nos interesa conocer su opinión sobre el sitio Web de la Comisión para el Mercado Financiero (CMF)

Marque de 1 a 10, siendo 1 la peor calificación y 10 la mejor.