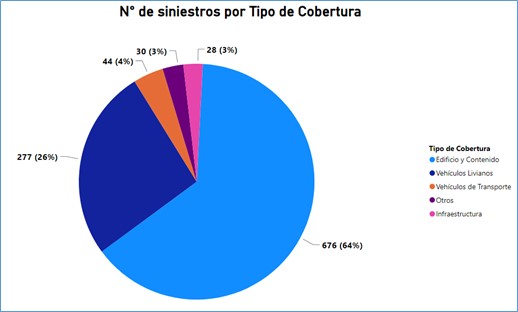

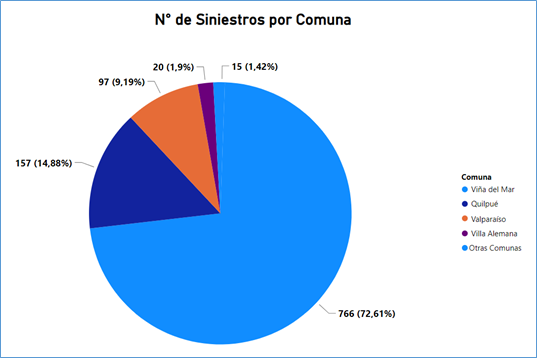

1,055 claims were filed to date before general insurance companies, with 64 percent concerning damage to real estate and 30 percent about damaged vehicles. The commune of Viña del Mar accounts for 72 percent of total claims.

The Commission reminds the public that according to General Rule No. 331 on minimum conditions and coverage to be included in mortgage-related insurance, they must state that the insured amount shall correspond to the property's appraised value rather than just the outstanding balance of the debt.

February 26, 2024 - The Financial Market Commission (CMF) reports on information submitted to date by insurance companies regarding the forest fires that affected the Valparaíso Region. On February 5, the CMF required companies to submit weekly reports on claims deriving from the catastrophe and amounts insured in stricken areas.

Companies were also required to strengthen their customer service channels and take all necessary measures to ensure affected policyholders have a quick settlement and payment of claims.

According to data compiled as of February 20, 1,055 claims were filed before general insurance companies. Most involved damage caused by fires to real estate (buildings and their contents), followed by damage to vehicles and infrastructure.

General Insurance Companies

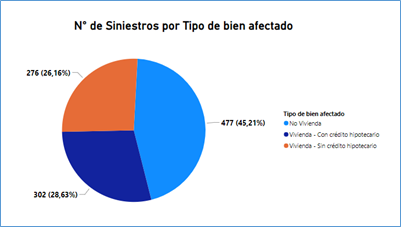

55 percent of total claims filed are about affected homes.

By commune, 72 percent of claims filed are in Viña del Mar.

Per the information submitted to date, the estimated exposure (i.e. amounts insured) in the most affected municipalities (Viña del Mar, Quilpué, Villa Alemana and Limache) of general insurance companies is around USD 120 million.

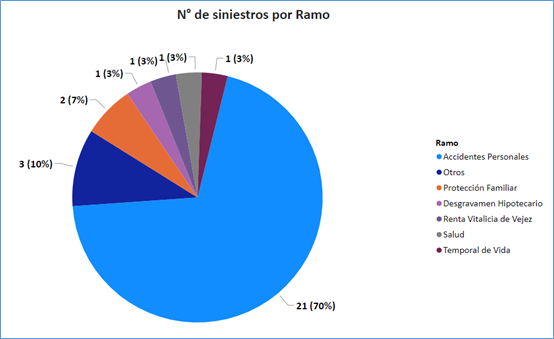

Life insurance companies report a total of 30 claims in the Valparaíso Region, mostly for personal accidents.

Life Insurance Companies

Coverages

The CMF reminds people that in the case of homes under current mortgage loans, the amount for fired insurance coverage is the property's appraised value (minus the land value) rather than just the outstanding balance of the debt.

In cases of total property loss, insurance companies pay the compensation to the mortgagee (e.g., bank, mutual company) to cover the outstanding balance of the debt (when the debt is less than the insured amount). The difference is then paid to the insured debtor.

Citizens can access the Online Insurance Inquiry System on the CMF website to consult in real time and free of charge any insurance policies they have taken with supervised companies. The service is accessed with the Individual Password issued by the Civil Registry and is open to titular parties to a policy, whether holder or insured; and third parties in the event of the policyholder's death or declared incapacity who can prove legitimate interest in obtaining such information.