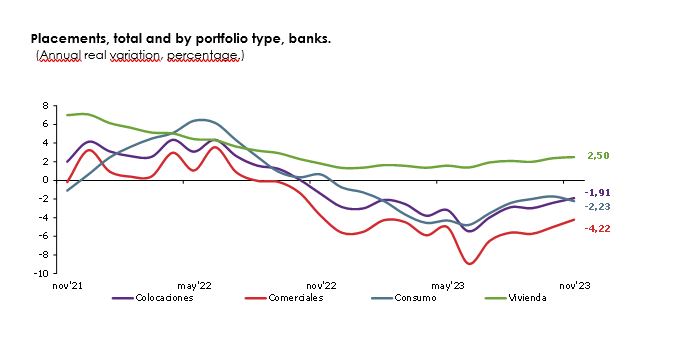

December 29, 2023 - The Financial Market Commission (CMF) reports that in November, placements in the banking system declined by 1.91% over a 12-month period. The decrease in placements was attributed to a 4.22% drop in commercial placements and a 2.23% retreat in consumer placements, both over a 12-month period. Meanwhile, the housing portfolio experienced growth of 2.50% over the same period.

In terms of credit risk, in November 2023, the 90 days or more delinquency and deteriorated portfolio indices of the banking system placements increased compared to the previous month, while the provision-to-placements ratio remained unchanged.

At the portfolio level, most risk indicators show a persistent upward trajectory, with the provision index for consumer placements and the delinquency and deteriorated portfolio coefficients for commercial, consumer, and housing placements increasing marginally.

Thus, the 90 days or more delinquency index rose from 2.07% to 2.13%, and the deteriorated portfolio index increased from 5.48% to 5.58%. This was explained, in both cases, by the higher coefficient in all three portfolios.

On the other hand, the provision-to-placements ratio remained at 2.55% compared to the previous month. The respective indicator increased in the consumer portfolio, decreased in the commercial portfolio, and remained unchanged in the housing portfolio.

Compared to 12 months ago, all credit risk indices on placements increased, as did those on a portfolio basis. The banking system's monthly result reached $420.531 million in profit (485 million USD), increasing by 11.26% in the month and decreasing by 24.03% over 12 months.

The return on average equity declined in the month to 15.19%, while the return on average assets rose to 1.12%. Compared to 12 months ago, both coefficients show a decrease.

Supervised cooperatives

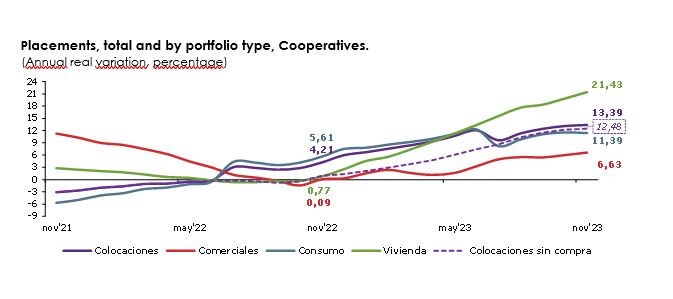

In November, placements of the credit unions supervised by the CMF expanded by 13.39% over a 12-month period. This rate includes the inorganic growth of the consumer portfolio attributed to the credit purchase made by a cooperative in December 2022. Excluding this effect, placements would have grown by 12.48%.

The consumer portfolio, which accounted for 71.47% of the total in October, is the main driver behind the placement trajectory, recording an 11.39% increase over 12 months. Excluding the portfolio purchase, consumer placements would have grown by 10.04% over 12 months. Meanwhile, the commercial portfolio expanded by 6.63% over 12 months, and the housing portfolio grew by 21.43%.

In terms of credit risk, the 90 days or more delinquency and deteriorated portfolio indicators increased during the month, while the provision-to-placements ratio decreased compared to the previous month.

The 90 days or more delinquency index rose to 2.60%, along with the respective coefficients for the commercial and consumer portfolios. The deteriorated portfolio indicator increased to 7.68%, explained by commercial placements. The provision index decreased to 3.66%, following a similar trend in the commercial and consumer portfolios.

Compared to 12 months ago, most credit risk indices on placements increased, except for the provision and deteriorated portfolio indicators for housing, which decreased over the period.

The monthly result reached $10,799 million in profit (12 million USD), decreasing by 18.07% in the month and 37.01% over 12 months. The return on average equity was 11.53%, and the return on average assets was 2.68%, both above the previous month's levels and below the indices from 12 months ago.