The Survey, financed alongside the Development Bank of Latin America and the Caribbean, identifies knowledge, attitudes, and behavior of people regarding financial issues.

Results show a slight regression in Chile's financial inclusion level, which is below the OECD average, since the 1st survey, with financial behavior being the main factor.

December 14, 2023 - Solange Berstein, Chairwoman of the Financial Market Commission (CMF), presented today the results of the 2nd Latin American Financial Capability Measurement Survey: Chile 2023. This study was financed by the Commission and the Development Bank of Latin America and the Caribbean (CAF), and identifies knowledge, attitudes, and behavior of people regarding financial issues. Its first version was carried out in 2016.

"We are convinced that financial education is a difficult task whose progress is slow, but in which persistence is important. That is why this survey is a significant contribution to better understand where we are and what decisions we can take to improve people's levels of financial education," Chairwoman Berstein stated during the presentation held in the Santiago campus of Pontificia Universidad Católica de Valparaíso (PUCV).

Following Solange Berstein's presentation, a panel discussion took place with the participation of María Teresa Blanco, Dean of the PUCV School of Economics and Administrative Sciences; Rodrigo Alfaro, Manager of Financial Studies of the Central Bank of Chile; and Nancy Silva, General Director of Studies of the CMF. The event wrapped up with a speech by Fernando Cubillos, New Businesses Manager of the CAF.

Main Results

The surveyed population is made up of men and women over 18 years of age from all socioeconomic levels. Even though it includes residents in urban and rural areas throughout the 16 regions of Chile, it is representative at a national level. Data was collected through a face-to-face survey of 1,212 respondents, with fieldwork carried out between April 29 and June 23, 2023. The results have a 2.8-percent margin of error.

According to the Financial Capabilities Survey, only 42 percent of respondents state that their income level is sufficient to cover their spending. When money is tight, their preferred strategy is to cut back on expenses, followed by working overtime and receiving support from their immediate community.

The Financial Capabilities Measurement Survey calculates a financial education score for the population, associated with the results observed in three dimensions: knowledge, attitude, and financial behavior. Chile's financial education score reached 12.2 points, slightly above the minimum of 12 points established by the International Network on Financial Education (INFE) of the Organization for Economic Cooperation and Development (OECD).

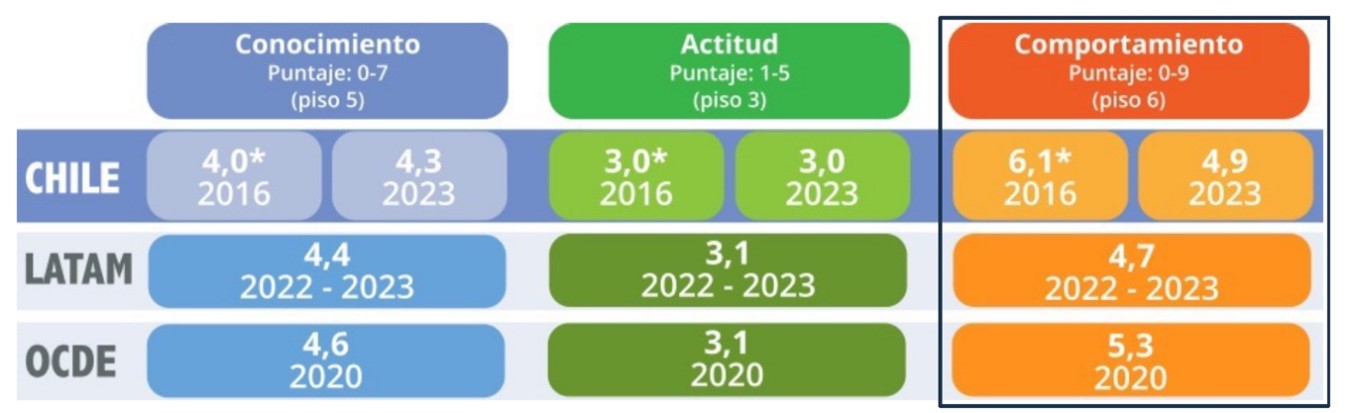

The Chilean score is lower than the OECD average (13 points) and below the one achieved in 2016 (13.1) yet like the Latin American average of 12.1. Compared to the 2016 Survey, there is a slight increase in knowledge and the attitude score shows no variation, but the behavioral dimension declines sharply.

Blue: Knowledge. Green: Attitude. Orange: Behavior. Scores from the 2016 Survey were recalculated using the 2018/2022 INFE/OECD methodology. Latin American averages correspond to the 2022-23 period.

The drop in the behavioral dimension is due to a decline in household resilience and less willingness to save, especially long-term. The Survey shows said change occurs in a post-pandemic context, characterized by economic deterioration because of the sanitary crisis, combined with less cautious financial behavior. Additionally, it reveals a low index of financial inclusion in the Chilean population, which reaches 45 percent (expressed as a percentage of the maximum 7 points) and is especially low in the elderly population at 37 percent.

For the migrant population (7 percent of surveyed people), the financial inclusion index does not show relevant differences for men. However, migrant women aged 40 or lower have a low inclusion level.

The study also includes a financial wellbeing index which gives Chile 9.7 points, just below the OECD average of 9.9. According to the Survey, the population with a high level of well-being (75th percentile and higher) is found among people with high school or college education and high incomes. Among the population with low financial wellbeing (25th percentile and lower), women aged 40-59 and with monthly incomes up to CLP 750,000 stand out.

Links to Relevant Documents