The Financial Market Commission (CMF) announces the release of its new Report on Investment Costs in Mutual Funds. Said Report, which deals with investment costs related to this type of financial instrument, is mainly focused on retail investors. It is also part of the Commission's work agenda to promote a more transparent and efficient financial market. The Report's main objectives are as follows:

- Provide clear, simple information on costs related to mutual funds marketed in Chile.

- Contribute to better financial education.

- Promote greater competition in the mutual funds industry.

The Report's importance is based on the Chilean mutual funds industry, which manages close to USD 60 billion in investments, has over 3 million participants, and is one of the main sources of savings in the local economy. A significant part of these savings corresponds to retail investors, and in some cases to voluntary pension savings plans. Given this context, the Report provides background information on investment costs for people to compare and make better informed decisions when choosing the best alternative in terms of risks and returns available in the market. It also considers variables like risk tolerance levels, investment horizons, and liquidity needs, among others.

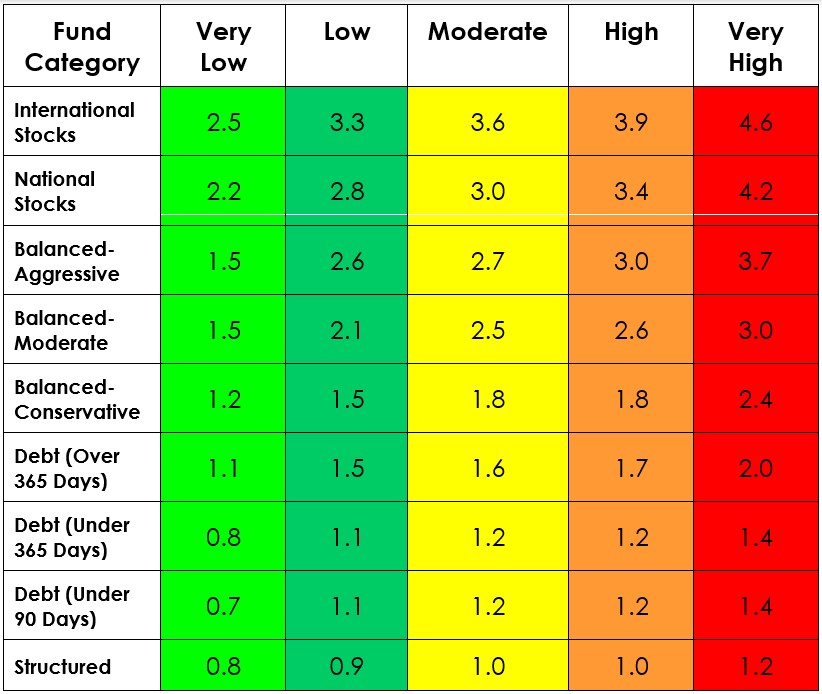

The Report provides data on the Annual Cost Rate (ACR) for different categories of mutual funds. An ACR is the annualized cost associated with an investment, which is expressed as a percentage of the fund's assets, including all remunerations and expenses that affect its performance. To make ACRs easier to understand, color-coded tables show "very high" rates (80th percentile and higher) in red. "Very low" rates (20th percentile and lower) appear in green.

The following table shows, as an example, that the median ACR for a National Stocks fund (in yellow) is around 3 percent, but "very high" funds charge over 4.2 percent.

ACRs for Retail Investors

(Percentage of Equity as of September 2023)

Calculations are made at the level of each fund series, and do not consider Voluntary Pension Savings series. Series aimed at retail investors are defined as those whose minimum investment amount does not exceed USD 100,000 (approximately CLP 90 million), in accordance with the Morningstar definition of retail investors. Excludes series intended for institutional investors, own funds, and high-net-worth investors. Each category includes ordered series for all general fund managers and shows the 20th, 40th, 50th, 60th, and 80th percentiles.

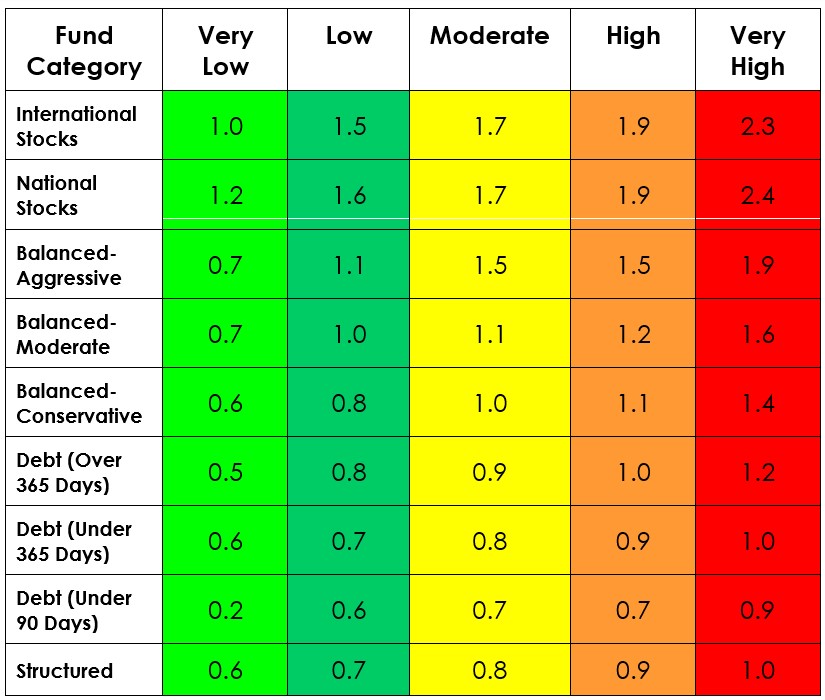

The report also compares ACRs for the series of mutual funds that offer the Voluntary Pension Savings modality. This is an investment account that allows people to make additional contributions to their pension fund, and whose main objective is to encourage long-term savings and improve members' future pensions.

ACRs for Voluntary Pension Savings Investors

(Percentage of Equity as of September 2023)

Calculations are made at the level of each fund series, and only considers Voluntary Pension Savings contributions. Each category includes ordered series for all general fund managers and shows the 20th, 40th, 50th, 60th, and 80th percentiles.

The Report includes a section of examples that compares the costs of investing in mutual funds and their impact on people's savings. In the event of significant differences that may be observed between ACRs of funds from the same general fund manager, or between fund managers, for funds with similar characteristics, it is recommended that clients consult their manager directly to know the rationale behind said differences.