- Interested parties can check and compare repair times by company, vehicle brand and model, and magnitude of the damage, as well as repair shops in each region of the country.

- In the second half of 2022, the average time vehicles were made available after an insured party made the claim reached 76 days, up from the average of 70 days recorded in the first half of last year.

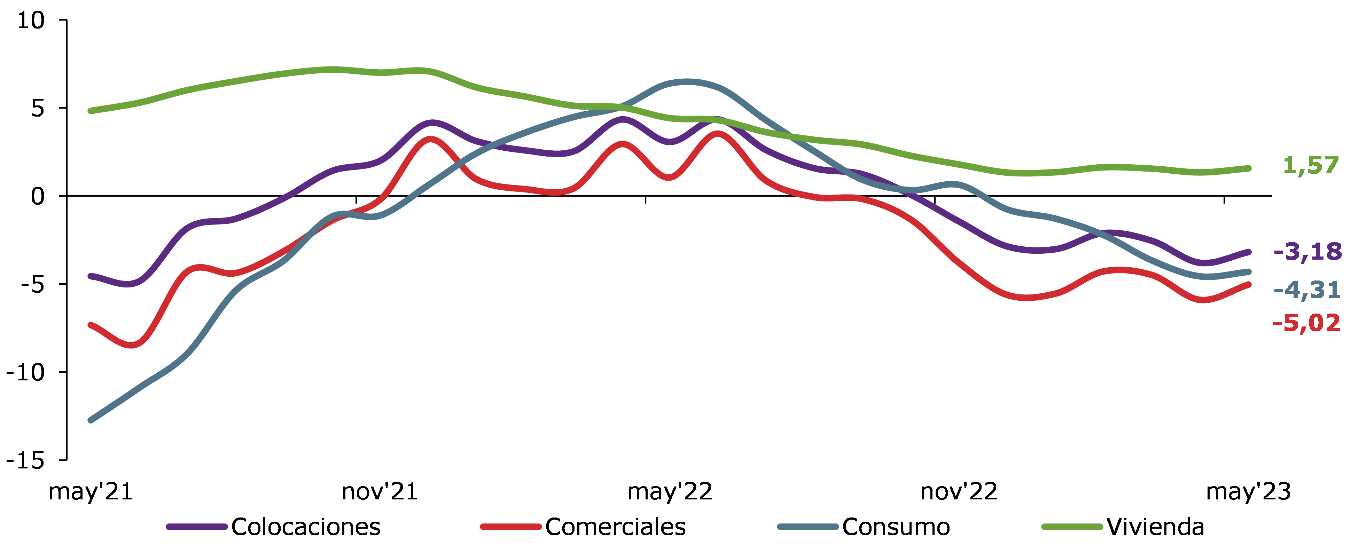

June 30, 2023 - Loans in the banking system fell 3.18 percent over 12 months, less than the 3.80-percent decline recorded in April. Lower contractions in the commercial and consumer portfolios, which declined by 5.02 and 4.32 percent (5.90 and 4.56 percent in April), respectively, explain this result. Housing loans, meanwhile, improved their growth compared to last month (1.57 percent versus 1.35 percent in April).

Consumer loans fell for the tenth consecutive month, while the downward trend for commercial loans now reaches six months, as Graph 1 shows.

Graph 1: Total loans and loans by portfolio in the banking system

(Real annual variation expressed in percentage)

Purple: Total loans. Red: Commercial loans. Blue: Consumer loans. Green: Housing loans.

Regarding credit risk, the loan-loss provisions index remained unchanged at 2.52 percent, albeit it showed dissimilar trends depending on the portfolio: it stood pat on housing, grew in commercial, and declined in consumer. Meanwhile, the impaired portfolio ratio increased to 5.17 percent for a 0.09-percent gain in May with growths across all portfolios. The arrears ratio of 90 days or more followed suit, rising from 1.90 to 1.93 percent. All credit risk indices grew across the board versus 12 months ago.

Monthly profits for May reached CLP 420,770 million (USD 523 million) for a decline of 27.55 percent during the past year. Accordingly, the return on average equity was 18.24 percent and the return on average assets was 1.27 percent, both lower than the ones posted in May 2022.

Supervised Cooperatives

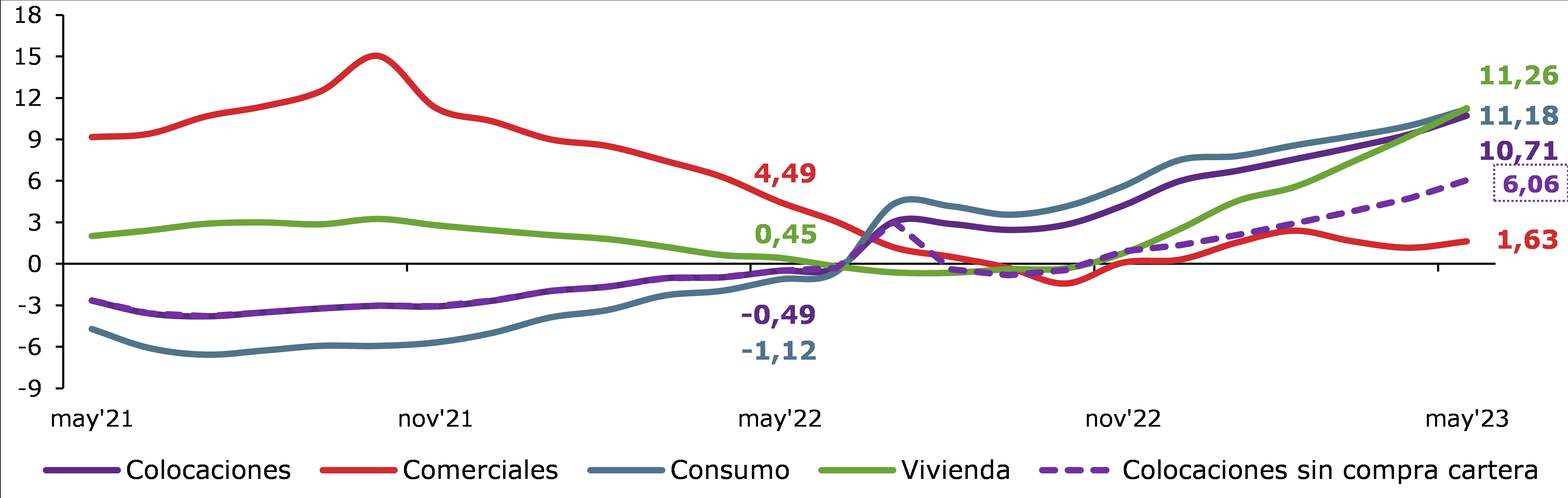

Loans in savings and credit cooperatives supervised by the CMF increased by 10.71 percent in 12 months, above the 9.36-percent growth posted in April. This figure considers the inorganic growth of the consumer portfolio resulting from a portfolio purchase made by a cooperative in 2022, which impacted the industry's activity from the second half of that year onwards. Excluding said effect, loans would have grown by only 6.06 percent during the month, still above the 4.73 percent that would have been recorded in March 2023 (measured in the same way), as Graph 2 shows:

Graph 2: Total loans and loans by portfolio granted by savings and credit cooperatives

(Real annual variation expressed in percentage)

Purple: Total loans. Dotted Purple: Total loans without considering portfolio purchase. Red: Commercial loans. Blue: Consumer loans. Green: Housing loans.

The consumer portfolio, which accounts for 72.39 percent of these loans, grew by 11.18 percent in 12 months and is the main reason behind this result. Excluding the portfolio purchase mentioned earlier, consumer loans would have grown by just 4.73 percent over the past year, also above the figure recorded in April 2023. The commercial portfolio rose by 1.63 percent in that span, above the 1.17-percent increase recorded the previous month. The housing portfolio grew 11.26 percent, above the 9.24-percent jump recorded last month and the 0.45-percent increase seen last year.

As for credit risk, the provisions index, the arrears ratio of 90 days or more, and the impaired portfolio increased during the month, as did the ratios for commercial and consumer loans. The lone exception was the housing portfolio, whose ratios decreased versus April 2023.

The provisions index increased from 3.50 to 3.63 percent, while the impaired portfolio ratio rose from 7.02 to 7.14 percent and the arrears ratio of 90 days or more increased from 2.63 to 2.69 percent. All were affected by increases in the commercial and consumer portfolios.

All indices grew versus 12 months ago. The provisions index increased due to higher levels in the commercial and consumer portfolios, while the arrears of 90 days or more and the impaired portfolio ratios trended upward across all portfolios.

Monthly profits for May amounted to CLP 4,982 million (USD 6 million), 51.26 percent lower than a year ago. Accordingly, the return on average equity was 13.84 percent and the return on average assets was 3.33 percent, both lower than the ones posted in May 2022.

Links to Relevant Documents

- Report on Performance of the Banking System and Cooperatives - May 2023

- Monthly Report on Financial Information of the Banking System - May 2023

- Report on Derivative and Non-Derivative Instruments of the Banking System - May 2023

- Arrears Ratio of 90 Days or More in the Banking System - May 2023

- Report on the Impaired Portfolio of the Banking System - May 2023

- Assets and Liabilities of the Chilean Banking System Abroad - May 2023

- Balance Sheet and Statements of Banks (in plain text format) - May 2023

- Financial Report of Savings and Credit Cooperatives - May 2023