- Companies required to report in this first stage have total consolidated assets over UF 20 million and represent 24 percent of issuers. Another 11 companies voluntarily reported voluntarily in compliance with the requirements, with six of them being subsidiaries of companies that had to comply with the standards.

- Four banks and one life insurance company disclosed their Reports following the requirements of General Rule No. 461, while seven banks and two life insurance companies disclosed information under SASB Standards even though said General Rule is not yet applicable to them.

June 9, 2023 - In compliance with the timeframes established by General Rule No. 461, the Financial Market Commission (CMF) reports that 70 issuers of securities submitted their 2022 Integrated Report, a document that now includes information on sustainability and corporate governance.

These 70 companies, with total consolidated assets over UF 20 million, represent 24 percent of corporate securities issuers and 54 percent of total assets as of December 31, 2022 (excluding banking entities). 11 companies to which the requirements of General Rule No. 461 for their 2022 Reports were not applicable voluntarily disclosed their information. Six of them are subsidiaries of companies required to comply with the standards set forth in said General Rule.

Reach of New Integrated Reports

The Commission issued General Rule No. 461 to require supervised entities to include sustainability and corporate governance issues in their annual report, also known as Integrated Report. The requirements include information on the entity's profile; governance; risk management system; strategy; business model; personnel; and supplier management. It also considers the submission of certain metrics through two forms available on the CMF website. The first one is to report sustainability metrics established by the Sustainability Accounting Standards Board (SASB) related to the industry that, according to the Board of Directors of each entity, is most relevant. The second form deals with metrics related to the composition of the Board of Directors, personnel, and legal and regulatory compliance regarding different stakeholders and legislations.

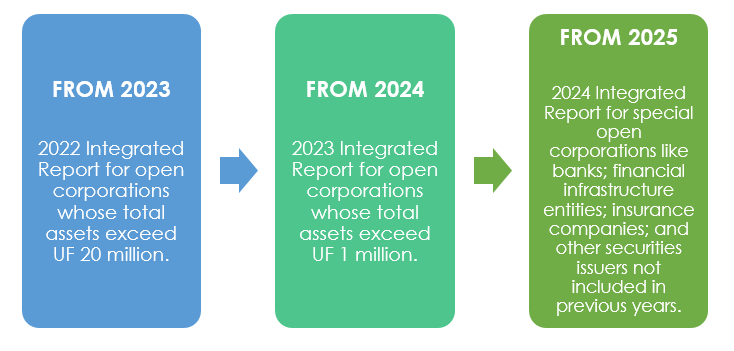

General Rule No. 461 applies to entities supervised by the CMF like issuers of corporate securities, banks, and insurance companies. Its reporting obligations were applied gradually, with the first stage for 2022 including open corporations whose total consolidated assets, calculated as of the beginning of the fiscal year disclosed in the Annual Report, exceed UF 20 million. Due to this gradual implementation, the reports of the remaining entities to which this requirement applies will be mandatory on a deferred basis during fiscal years 2024 and 2025, depending on the securities issuer's size. Banks and insurance companies shall begin submitting their Integrated Report starting with fiscal year 2024.

To date, all obligated companies have sent their respective integrated reports to the CMF, as well as their forms on ESG metrics.

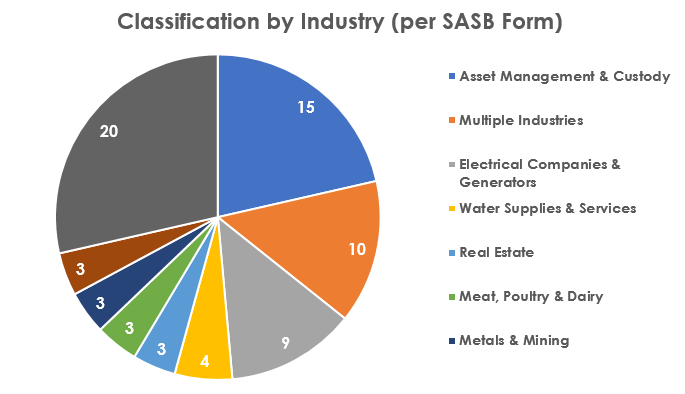

The following graph breaks down the industry sectors used by issuers to identify themselves according to the definitions of the Sustainable Industry Classification System (SICS). Most of them self-identified as asset managers.

As for the financial sector, for which the standard does not yet apply, four banks reported in compliance with General Rule No. 461 and seven of them disclosed information under SASB Standards. On the other hand, one life insurance company disclosed in line with said General Rule and two of them reported using SASB Standards.

The Commission has a special section on its website for corporate issuers where interested parties can find the list of reporting entities under General Rule No. 461, both mandatorily and voluntarily. It also features direct links to their submitted SASB and 461 Forms. In any case, background information on each entity is available individually on the website, allowing a review of its financial, legal and sustainability information.

Next Steps