November 23, 2022 - The Financial Market Commission (CMF) released today the 5th version of its Annual Regional Banking Statistics Report, which details coverage of and access to banking services and products. This Report aims to provide information on the banking infrastructure throughout the country and the levels of savings and credit of the Chilean population, contributing to the analysis of local economies and providing background information to develop public policies for banking penetration and financial inclusion.

The CMF's Commissioners will present the Report at three regional events organized jointly with the Universities of Talca, Concepción and La Serena.

Evolution of Savings and Other Deposits

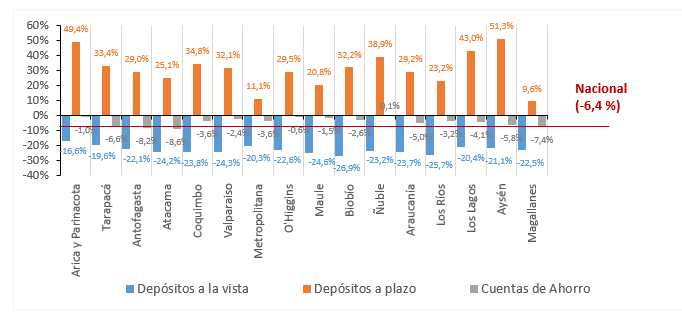

According to the Report, as of June 2022 nationwide deposits decreased by 6.4 percent in real terms during the past 12 months, a phenomenon observed in all regions of the country and related to the end of liquidity injection measures carried out during the pandemic, as well as rising interest rates related to the subsequent inflation growth.

Deposits by Type of Product and Region

Balances and Their Real Variation in 12 Months

On-demand deposits in blue, term deposits in orange, savings accounts in gray.

Reductions observed in term deposits and savings accounts, which were not partially offset by the increase in time deposit balances, are the main reason behind this decline. The largest increases in term deposit balances were recorded in Aysén (51.3 percent); Arica y Parinacota (49.4 percent), and Los Lagos (43 percent).

In housing savings accounts, all regions had real decreases in their average balances, with the largest decline reported in Atacama (minus-8.6 percent).

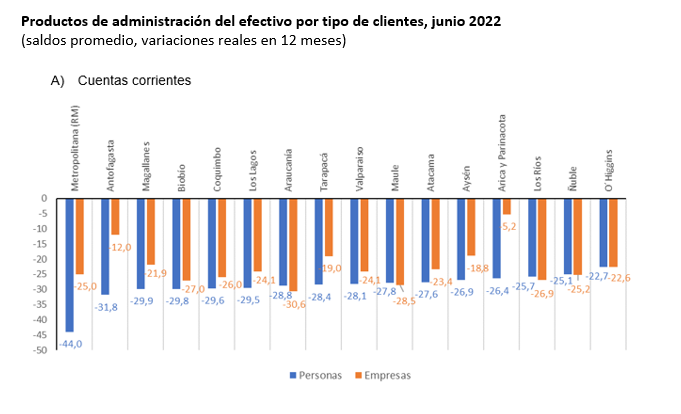

As of June 2022, there are 7.7 million checking accounts and 26.4 million vista accounts opened. This represents an increase of 26.2 and 12.3 percent, respectively, versus June 2021. However, average balances in checking accounts had a real decline of 39.8 percent for individuals and 25.1 percent for legal persons. All regions showed a real reduction in average checking account balances, with the Metropolitan Region standing out for individuals (minus-44 percent) and Araucanía for legal persons (minus-30.6 percent).

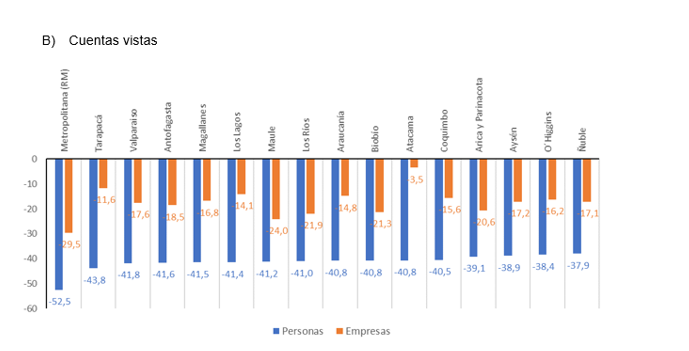

Vista account balances also fell by 47.4 percent for natural persons and 22.8 percent for legal persons. The Metropolitan Region has the largest drop in both categories at 52.2 and 29.5 percent, respectively.

Cash Management Products by Client as of June 2022

Balances and Their Real Variation in 12 Months

A: Checking accounts. B: Vista accounts. Individuals in blue, legal persons in orange.

Regarding population coverage of banking products, the Metropolitan Region has the highest number of checking accounts per 100,000 individuals and legal persons at 73,450 and 91,557, respectively. On the other hand, Ñuble has the lowest such coverage of checking accounts for individuals and legal companies (13,349 and 28,116). For vista accounts the highest coverage per 100,000 individuals also corresponds to the Metropolitan Region (203,895 accounts) and the lowest to Ñuble (111,683). For legal persons, Antofagasta has the highest account coverage per 100,000 entities (32,373), and Maule the lowest (18,726).

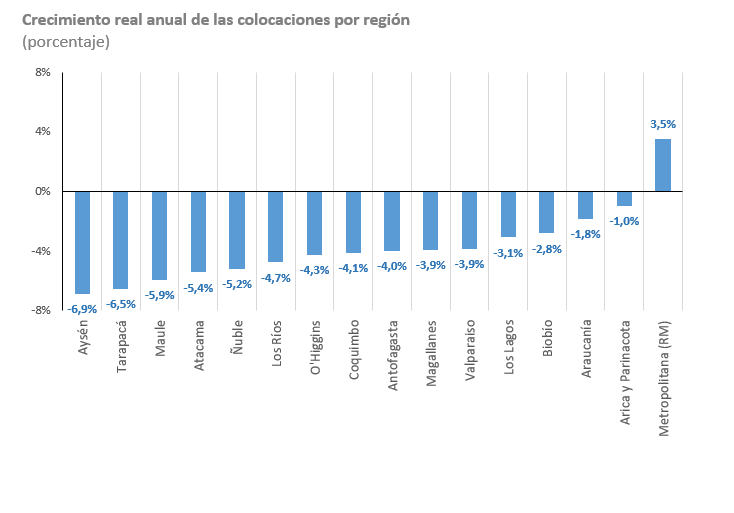

Indebtedness and Arrears

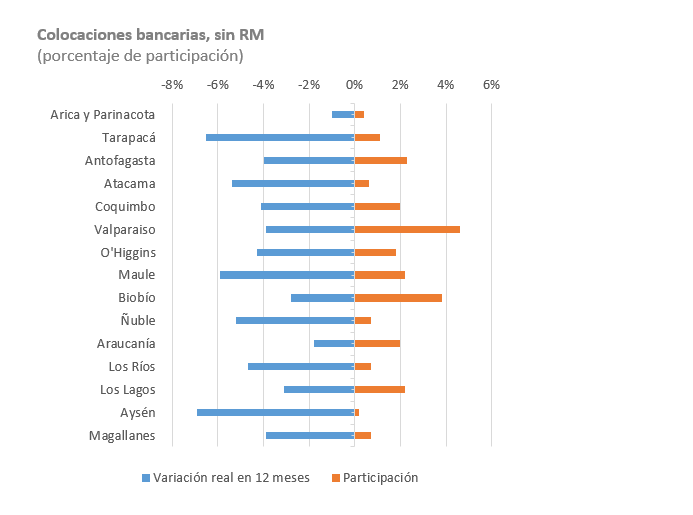

As of June 2022, 4.3 million individuals and 255,000 legal persons have banking debt. Total loans fell throughout the country, except in the Metropolitan Region, where they grew by 3.5 percent in real terms. The largest declines were recorded in Aysén with 6.9 percent and Tarapacá with 6.5 percent, whose shares in the country's total loans are of 0.2 and 1.1 percent. The Metropolitan Region represents over 70 percent of total loans.

Real Annual Increase of Loans by Region (%)

Bank Loans Excluding the Metropolitan Region (%)

Real variation over 12 months in blue, participation in orange.

The average debt by portfolio shows that consumer debt fell in real terms in all regions, with the largest reduction in Antofagasta: 10 percent. Average mortgage debt increased in real terms throughout the nation, with Tarapacá being the sole exception at minus-0.1 percent. The average commercial debt of individuals declined in all regions as well, with Tarapacá showing the largest variation (minus-15.9 percent).

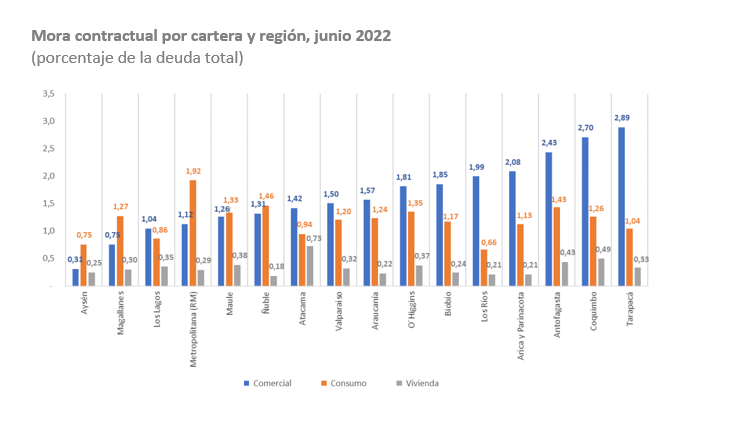

As of June 2022, the highest arrears in the commercial portfolio were in Tarapacá (2.89 percent) and the lowest in Aysén (0.31 percent). In the consumer portfolio, arrears are highest in the Metropolitan Region (1.92 percent) and in Atacama for housing loans (0.73 percent).

Contractual Arrears by Portfolio and Region as of June 2022

Percentage of Total Debt

Commercial portfolio in blue, consumer portfolio in orange, housing portfolio in gray.

Bank Branches

As of June 2022, there were 17 active banking institutions in Chile with a total of 1,640 physical locations distributed among head offices, branches, auxiliary tellers and support offices. This represents a decrease compared to the 1,794 recorded on June 2021. 42 percent of the decrease corresponds to regions other than the Metropolitan Region (64 locations)

The number of bank branches decreased in 48 communes belonging to 14 different regions; only Atacama and Aysén showed no variation. Tarapacá had the largest contraction with 23.1 percent less branches. The total number of ATMs also decreased, with 7,602 belonging to 11 banks as of June 2022 versus 7,680 a year earlier.

74.4 percent of municipalities in Chile have bank branch coverage, compared to 24.5 percent for cooperatives. 94 communes lack bank branches; 277 lack cooperative branches; and 78 lack both. 48 communes, equal to 13 percent of the nation's territory, do not have ATMs.