- New data include monthly indicators of debt level, financial burden, and leverage of debtors in the banking system.

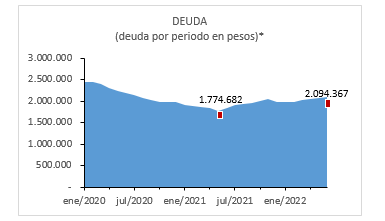

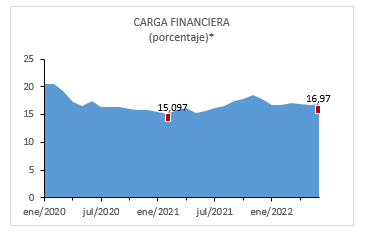

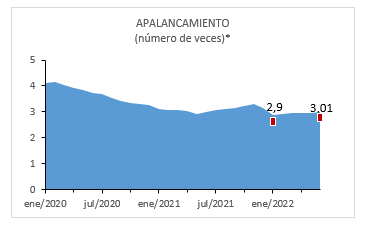

- Median debt reached CLP 2,094,367 as of June 2022. The financial burden was 16.97 percent, and leverage reached 3.01 times income.

Monthly indicators on number of debtors and arrears according to debt term, institution, and gender, are also available in the CMF's Temporary Series Statistical Database.

September 5, 2022 - The Financial Market Commission (CMF) presents a series of new statistics on individual indebtedness. Monitoring people's indebtedness is particularly relevant to the CMF since greater and better access to credit allows people to absorb temporary mismatches between income and expenses, therefore increasing their well-being. However, high levels of indebtedness can affect households' ability to meet their commitments and make them more vulnerable to shocks, negatively impacting the stability of the financial system.

This new dataset provides detailed information on indebtedness and arrears according to debt term, institution, and gender. They are available in the CMF's Temporary Series Statistical Database (BEST, for its Spanish acronym) though the menu on the left side of the screen.

Details of these new statistics, their location in the BEST platform and their periodicity are displayed in the following table. A direct link is also included for added convenience.

|

Dataset |

Location in BEST |

Periodicity |

First Available on… |

|

Risk & Performance / Risk / Household Indebtedness |

Monthly |

January 2017 |

|

|

Clients / System Debtors / By Portfolio and Term of Debt |

Monthly |

January 2016 |

|

|

Clients / System Debtors / By Financial Institution and Term of Debt |

Monthly |

January 2016 |

|

|

Gender / Indebtedness / Debtors |

Monthly |

January 2016 |

|

|

Risk & Performance / Risk / Banks / Credit / Arrears / System / By Portfolio / Amounts |

Monthly |

January 2016 |

|

|

Risk & Performance / Risk / Banks / Credit / Arrears / By Financial Institution / Amounts |

Monthly |

January 2016 |

|

|

Gender / Arrears / Amounts |

Monthly |

January 2016 |

Related indicators and their distributions are built based on microdata obtained as part of the CMF's supervisory process. The methodological approach used in these reports differs from that used in other measures of personal indebtedness, which are mostly based on demand surveys.

Indebtedness Indicators

New data includes indebtedness Indicators which consider the evaluation of three dimensions of indebtedness:

- Debt Level (median of banking system debtors in CLP)

- Financial Burden (percentage of monthly income allocated to pay financial obligations).

- Leverage (number of monthly incomes debtors would need to fully pay their financial obligations).

The main variations observed for all three indicators over the last 30 months are highlighted below, with limited increases being recorded. The median debt of debtors in the banking system reached CLP 2,094,367 in June, while the financial burden was 16.97 percent, and leverage was 3.01 times income.

Note: Values shown correspond to the median of the distribution. Red dots highlight the latest available data (June 2022) and the lowest value observed during the last 30 months.

Debtors and Arrears

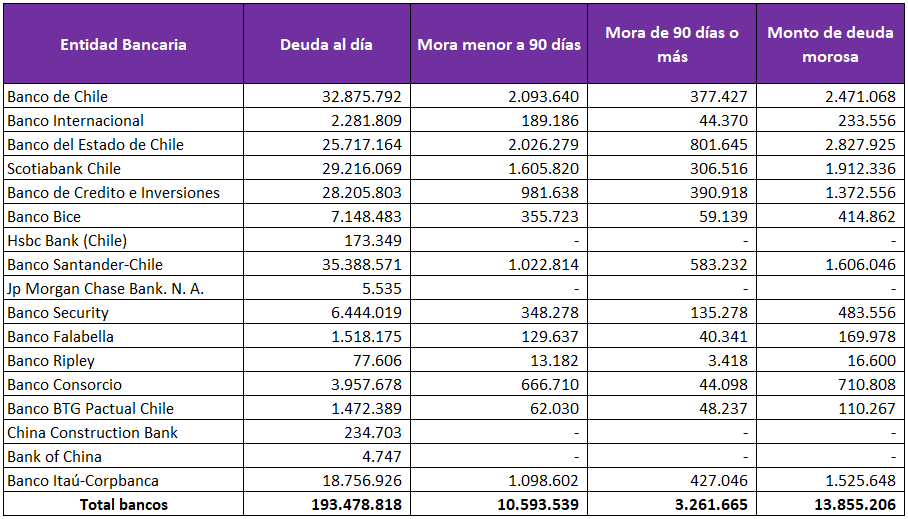

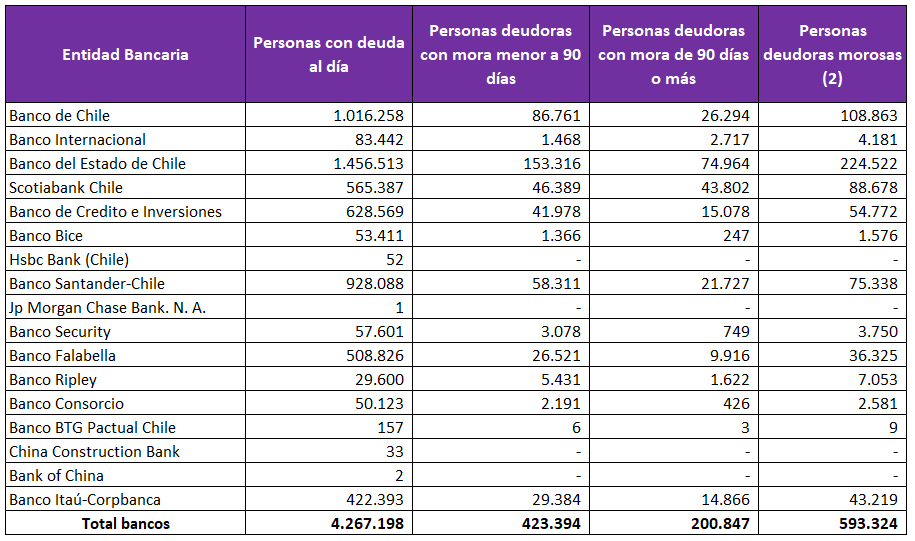

The new indicators also provide information on debt and arrears by term and financial institution, as shown in the following tables:

Source: CMF

Notes

- Debtors are grouped in Table 1 according to the longest arrears in days reported for each type of asset and bank. This means the same debtor can appear in multiple arrears categories.

- Table 2 displays the net amount (by unique National ID Number) of debtors for every bank. For example, a debtor with debts in different types of assets whose arrears are distributed in more than one category will be counted as one in the total for each institution and, at the same time, in the total of the banking system.