- The Gender Report addresses women's and men's access to the financial system, contributing to the design and implementation of public policies on gender equity.

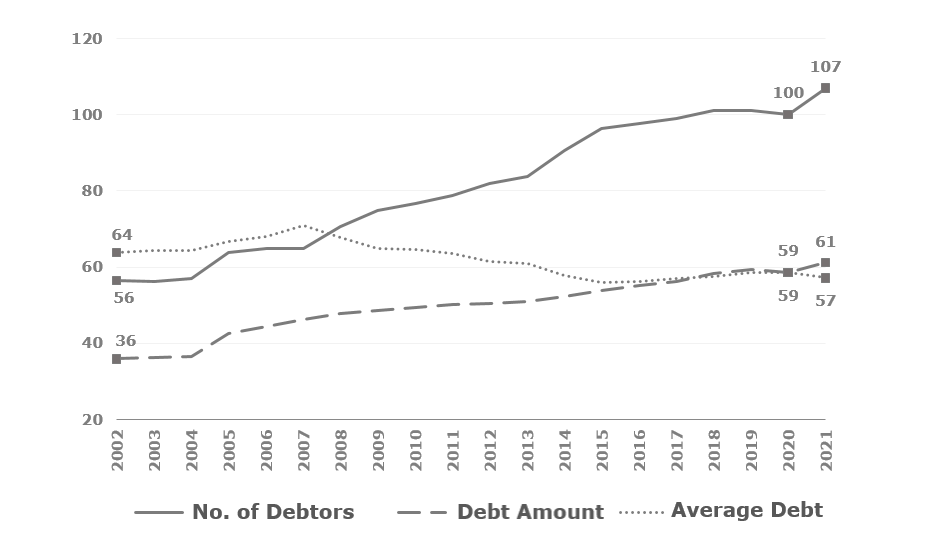

- Gender gaps in favor of women in terms of the number of clients in the financial system are closing, but differences persist in terms of loan amounts versus men.

- While the number of female bank debtors is 7 percent higher than their male counterparts, the total amount of outstanding bank credit for women is 39 percent lower, and their average debt is 43 percent below men's.

- This is even though women systematically maintain lower arrears rates and higher savings levels than men.

August 22, 2022 - The Financial Market Commission (CMF) presented today its 2022 Report on Gender in the Financial System. This is the 21st version of the Report, which addresses women's and men's access to financial services in Chile with the aim of contributing to the design and implementation of public policies on gender equity. Starting this year, the Report also includes information from the Gender Handbook compiled by the Commission, including indicators on parity in access to management positions.

CMF Chairwoman Solange Berstein presented the 2022 Gender Report's results on a webinar organized by the CMF, stressing the results show that "despite the observed reduction in economic gender gaps, there is still room for improvement to generate greater growth and inclusion in the Chilean economy. Over time, women show lower arrears rates than men and more solid financial integrity variables, such as financial burden and leverage. This should be reflected in the conditions under which they access financing," added the Chairwoman. Regarding gaps in the participation of women in management positions, Mrs. Berstein said that "despite obvious advances, it is revealed that closing this gap could take decades."

Solange Berstein's presentation was followed by a panel discussion moderated by CMF Deputy Chairman Mauricio Larraín and featuring Undersecretary of Labor Giorgio Boccardo; BancoEstado President Jessica Pérez; and Eric Parrado, Chief Economist and General Manager of the Inter-American Development Bank's Research Department.

Participation in Boards of Directors

The 2022 Gender Report highlights that female labor participation shows significant gaps versus that of men. Although these gaps have moderated in recent years, the COVID-19 pandemic meant a decade-long setback in women's labor market participation. In the financial system, the Report states that several studies mention the positive effects of adding women to boards and management of companies. Some of them include positive impacts on firms' results and an increase in the retention of talent by stimulating the growth of other women within their organizations.

Table 1: Women's participation on boards of directors of financial system entities in 2021

|

Sector |

Participation (%) |

Last-Year Growth (%) |

3-Year Average Growth (%) |

Gender Parity Reached in… |

|

Banks |

8 |

12.5 |

4.9 |

38 Years |

|

Banking Subsidiaries & Support Companies |

9 |

-4.4 |

-2.8 |

N/A |

|

Savings and Credit Cooperatives Supervised by the CMF |

26.4 |

-5.8 |

5 |

13 Years |

|

Non-Banking Payment Card Issuers |

8.6 |

-30 |

-3.7 |

N/A |

|

Insurance Companies |

22.1 |

28.3 |

22.4 |

4 Years |

|

IPSA Companies |

15.3 |

27.2 |

21 |

6 Years |

|

Publicly Traded Companies |

12.6 |

22 |

12.2 |

12 Years |

As of December 31, 2021, the participation of women in management positions in IPSA companies was 15.3 percent, increasing to 19.4 percent by June 2022. In publicly traded companies said figure was 12.6 percent at the end of 2021. There are significant differences by sector. Savings and credit cooperatives (26.4 percent) and Insurance Companies (22.1 percent) have the highest female participation levels. Banks, their subsidiaries and support companies, and issuers of non-bank credit cards are all below 10 percent.

Access to Financial Products

In line with trends observed in previous years, the 2022 Gender Report reveals that gender gaps in favor of women regarding the number of financial system clients are closing, while gaps linked to the amount of loans persist. As of December 2021, the number of female bank borrowers is 7 percent higher than the number of male borrowers. However, the total amount of outstanding bank credit for women is 39 percent lower, and their average debt is 43 percent below that of men. This is despite the fact that women systematically maintain lower arrears rates than men and better financial integrity variables like financial burden and leverage.

Graph 1: Women's aggregate bank credit over men's aggregate (in percentage)

Women's share (product holdings) in the portfolio of non-banking credit card issuers is significantly higher than that of men: 66.7 versus 33.3 percent. However, the average amounts of women's obligations are significantly lower than those of men. In savings and credit cooperatives supervised by the Commission, women also have a higher participation share than men. Over the last few years, population coverage of the sector's products has increased more for women. Finally, in endorsable mortgage mutual managers, relative participation of women has increased both in number of operations and lent amounts.

Housing Debt

The Report also highlights that women's debt persistently shows a higher proportion of housing debt than men's. Bank housing debt reached 65 percent of women's total debt in 2021, while for men it reached 61 percent. The gap has closed over the last decades, though the trend has reversed in the last two years. Accordingly, women have a more active demand for housing savings products, both in terms savings house composition and the stock of housing savings accounts. On the other hand, men have a higher percentage of commercial debt than women.

Savings Products

According to the Report, the overall number of banking savings accounts contracted by individuals exceeded 25 million in 2021, surpassing the country's total population. The number of accounts held by women exceeds that of men by 39 points, a gap in favor of women observed both at the global and relevant specific products level, such as housing savings and term deposits.

Links to Relevant Documents