- The new Capital Adequacy Ratio incorporates market risk and operational risk into the measurement of Risk Weighted Assets, in addition to the methodological changes introduced by the Commission to calculate credit risk.

- The Basel III capital framework will allow for a more solid and robust banking system - a fundamental condition to face impacts of economic downturns with better tools and contribute to the recovery of economic activity.

March 3, 2022 - The Financial Market Commission (CMF) published today the capital adequacy ratios for banks under the new Basel III standards. The new General Banking Act (LGB), published in 2019, defined general guidelines for setting new capital requirements for banks in line with Basel standards. It also empowered the Commission to regulate the capital framework applicable to these institutions.

During 2020, the Financial Market Commission completed the process of issuing Basel III-related regulations and began implementing these standards, which establish regulatory capital requirements necessary to address the main risks of banking. Regulations referred to articles 55, 55 Bis, 66 and 67 of the LGB were issued for this purpose.

The new capital framework will allow for a more solid and robust banking system - a fundamental condition to face impacts of economic downturns with better tools and contribute to the recovery of economic activity. In addition to improving bank capitalization levels, the new standards facilitate access to new and better sources of financing, harmonize requirements between subsidiaries of foreign banks and local banks, and contribute to the internationalization process of the Chilean banking system.

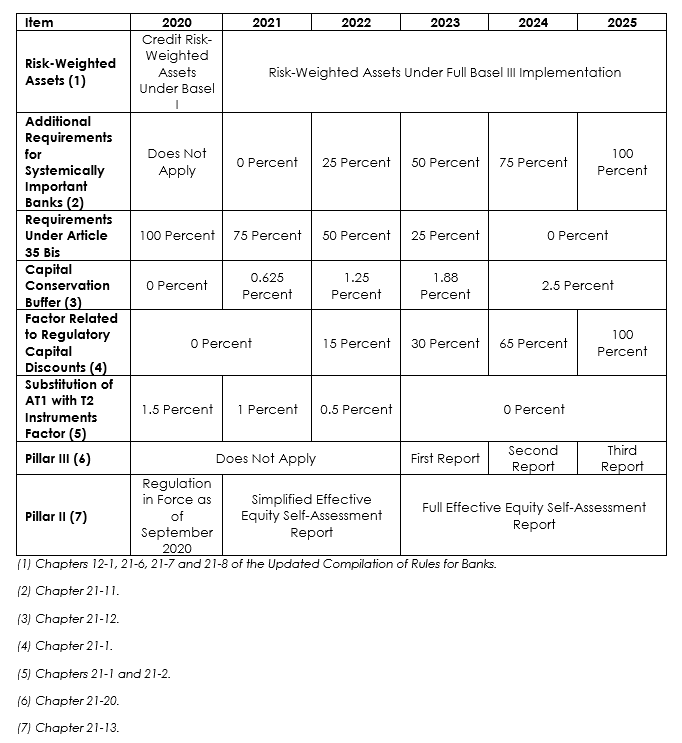

The regulatory framework established that the new requirements will be implemented gradually, as summarized in Table 1.

Table 1: Basel III implementation schedule as of December of each year

In line with this implementation schedule, as of this year the CMF shall begin monthly publication of Capital Adequacy Ratios (CARs) applying the new definitions set in the LGB. The denominator of the new CARs incorporates market risk and operational risk to the measurement of Risk-Weighted Assets (APRs), whose prior calculation only considered credit risk. Furthermore, the new ratios consider the new methodology enacted by the CMF in 2020 to measure credit risk.

In the ratio's numerator, effective equity incorporates adjustments and exclusions of accounting items of assets and liabilities, in addition to new instruments that qualify as regulatory capital - including perpetual bonds.

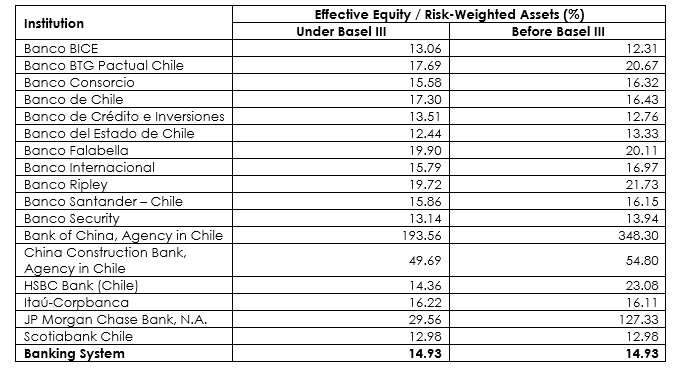

To facilitate reading and comparability of these ratios under the new Basel III methodology, Table 2 shows the capital adequacy ratio calculated for each bank under the new and the old standards.

Table 2: Capital Adequacy Ratios as of December 2021

Alongside the monthly report on Basel III solvency standards, the Commission will publish this month - and for the next two months - the solvency indicators under the regulations that were in force until November 2021.

Links to Relevant Documents