- This tool allows users to quote and compare interest rates and installment value for a housing loan of up to UF 20,000 at entities supervised by the Commission.

- The simulation uses the most widely available type of mortgage loan - non-endorsable, fixed rate mutual mortgages - to ensure comparability.

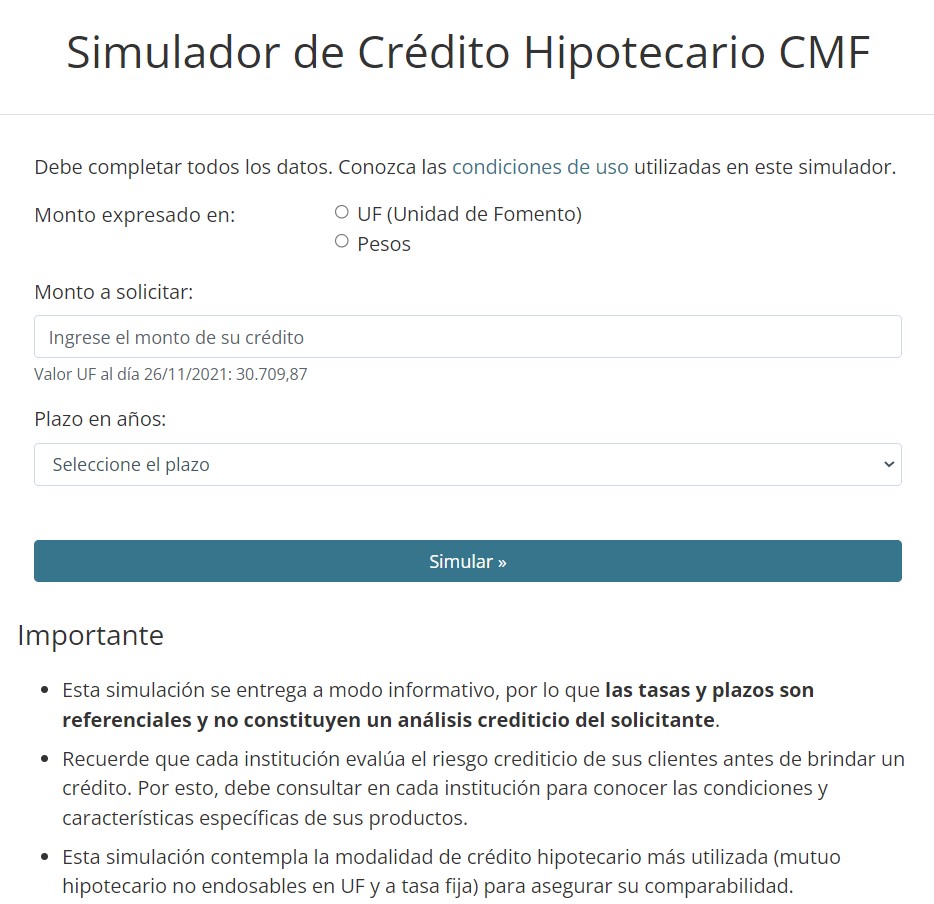

November 26, 2021 - The Financial Market Commission (CMF) released today its new Mortgage Loans Simulator. This tool, available on the CMF Educa website, allows users to quote and compare the costs of housing loans at entities supervised by the Commission. To ensure comparability, the simulation uses offers of non-endorsable, fixed rate mutual mortgage loans - entities finance the loan with their own resources, and it cannot be transferred to third parties - calculated in UF with a fixed interest rate.

By filling in the information on the amount to be requested and payment terms on the CMF Educa website, users can compare interest rates and monthly installment values, as well as mandatory insurance costs, in financial institution that grant this type of loan. Reported rates apply to a standard product with the following features:

- The loan amount equals 75 percent of the property's value.

- The property to be financed is in the Santiago Metropolitan Area.

- In the case of related insurance - fire, or fire plus earthquake - it is assumed that the property's full appraisal value, minus the land, is insured.

- The interest rate is expressed annually, in arrears, and on a 360-day basis.

How to Use the Simulator

Fill the requested information with the requested amount up to UF 20,000 and the payment term in years.

The results provided are strictly for reference purposes, and do not constitute an analysis of the user's credit score. Before granting a loan, each financial institution must evaluate its clients' credit risk. Therefore, interested parties should consult with each institution directly to learn about the conditions and specific characteristics of financial products.

The Commission also reminds users that there are additional expenses and costs related to housing loans which are not included in the amounts requested. Some examples include taxes, notary fees, and any other item agreed upon by the contracting parties. As a result, all rates reported are standard and do not include special offers for customers operating multiple financial products or based on specific agreements and/or promotions.

Data included in the new CMF simulator is provided by financial institutions themselves. Institutions who don't provide quotation results either do not offer the product or have not submitted information to the simulation system.