January 16, 2020.- The Financial Market Commission (CMF) published today its 2019 Indebtedness Report. The report, corresponding to its sixth version, aims to contribute to the analysis of the individual indebtedness trend in Chile.

The report includes information on 5.6 million bank debtors totalizing 77 billion Chilean pesos in loans. This amount represents 81 percent of the total stock of consumer and housing loans in the financial system.

Furthermore, it includes an analysis concerning clients who have no financial obligations with banks but are indebted to non-bank card issuers (ETNBs, for their Spanish acronym) and savings and credit cooperatives (CACs, for their Spanish acronym) supervised by the CMF.

Monitoring the indebtedness of individuals is relevant to the Commission. The report emphasizes that "while greater and better access to credit allows people to absorb temporary mismatches between income and expenses, increasing their well-being in the process, a high level of debt can affect the capacity of households to meet their financial commitments, making them more vulnerable to aggregate shocks and generating a negative impact on the stability of the financial system."

Although the Indebtedness Report refers only to bank debtors, meaning any person who has any kind of obligation to banks, the document includes both their banking and non-banking debts registered in the Commission's records.

The report's methodology focuses on evaluating three dimensions of indebtedness:

- Level of Indebtedness: the amount of money that a financial institution lends to an individual.

- Financial Burden: the percentage of monthly income allocated to the payment of financial obligations.

- Financial Leverage: the number of monthly incomes a debtor would need to allocate to fully meet their financial obligations.

Key Results

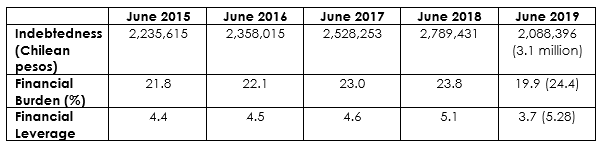

According to the report, as of June 2019 the financial obligations of bank debtors in Chile -- defined by a median distribution -- reached 2,088,396 pesos. Meanwhile, the financial burden and leverage indices were 19.9 percent and 3.7 times, respectively.

The report stresses that the reduction in these indicators compared to the previous year (see table) is mainly explained by the transfer of debtors from non-bank card issuers to support companies of banking activities (SAGs, for their Spanish acronym). It is worth mentioning that by the end of 2018 two non-bank card issuers were integrated as SAGs directly dependent on banking institutions, so their loans were consolidated in the system. The latter had an impact on bank debtor indicators, as new entrants have lower and shorter-term debts.

If this had not happened, indebtedness indicators would have continued the upward trend recorded in previous periods: median debt of 3.1 million pesos, financial burden of 24.4 percent, and financial leverage of 5.28 times per income, respectively.

The results are summarized on the following table:

Values in parentheses exclude the consolidation of two card-issuing SAGs at the end of 2018. Source: CMF.

The report also shows significant differences in indebtedness by geographical area, age bracket, and income level. The region with the highest debt level is Antofagasta, with 3.8 million Chilean pesos. Debtors between 35 and 40 years of age have the highest debt level at 4.8 million pesos. People with incomes over 1.2 million pesos account for 64.4 percent of the debt.

Median consumer debt is 1.7 million pesos, and median housing debt is 23.7 million pesos.

Additionally, 1,132,204 bank debtors had an unpaid debt of one day or older as of June 2019. 11.1 percent of this group had arrears of 90 days or more. 20.4 percent of bank debtors overall have arrears.

Vulnerable Debtors

The report also analyzes the situation of the so-called "vulnerable debtors," defined as individuals who have a high proportion of unpaid debt and high financial burden.

The first group, with a high proportion of unpaid debt, includes segments with an arrears rate above the median, such as debtors who earn less than 500,000 pesos a month; adults over 65 years of age; and young people under 30 years of age.

The second group includes debtors whose financial burden exceeds 50 percent of their monthly income. As of June 2019, 18.8 percent of debtors had a burden over half of their income, a lower figure than the one observed on the same date of the previous year (22.6 percent). Meanwhile, 26.6 percent of debtors showed a burden greater than 40 percent of their income, an amount similar to 2018.

The report also underlines that a lack of consolidated debt information can affect significantly and asymmetrically the different financing providers, as well as generating conditions for over-indebtedness in some segments of the population.

Regarding loans financed by insurance companies, clients' debt indicators increase significantly when considering the information on obligations to other institutions.

The 2019 Indebtedness Report and its corresponding Presentation with the key results are available on the CMF website.