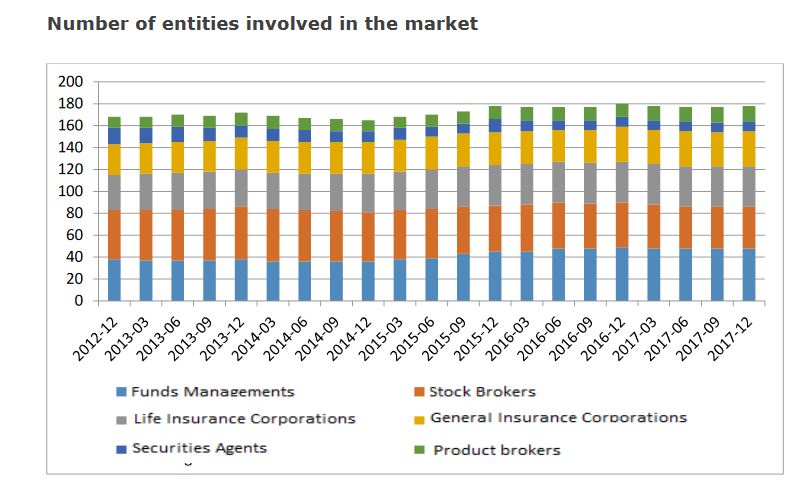

May 4th, 2018.- Today, the Financial Market Commission (CMF for its initials in Spanish) published the "Quarterly Statistical Report" on securities and insurance markets corresponding to the fourth quarter of 2017. The report has the purpose of showing the evolution of the different statistical variables of the main participants of the market overseen by the CMF, such as fund administrators, insurance corporations, securities agents, stockbrokers, and product brokers.

The purpose of this publication is to contribute to a wide and proper circulation of relevant information for the analysis and decision-making on behalf of market agents, and to the knowledge of investors and policyholders.

This document graphically shows the variables behavior relating to the number of market participants, investment portfolios, and assets managed by funds and insurance corporations, amounts traded on secondary markets, and performance indicators by industries. The report shows information regarding the last quarter of 2017, compared with background information from the year 2012, based on the information sent to the CMF by the overseen entities.

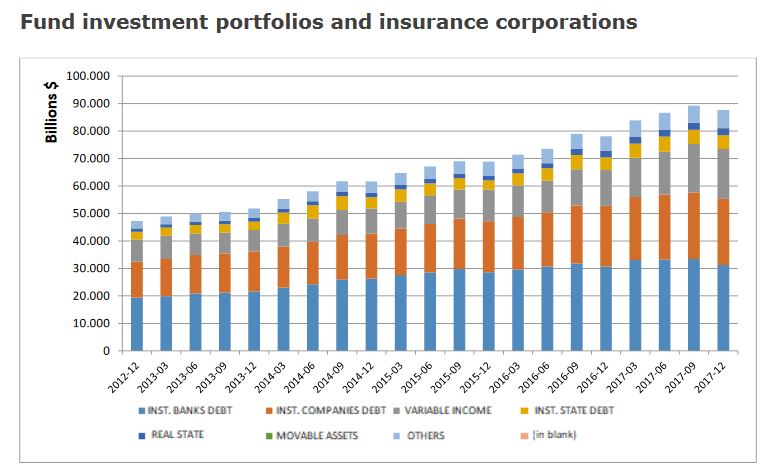

- At the end of the fourth quarter in 2017, the mutual fund investment portfolios, investment funds, and general and life insurance corporations totaled US$142,000,000,000, which represents a drop of 1.82% regarding what was registered in September the same year. This drop is mainly given due to minor investments in bank debt instruments, and by government and company debts to a lesser extent. This respectively decreased US$3,539 million, US$33.8 million, and US$273.9 million during the aforementioned period.

- In terms of the investment portfolio diversification for country of origin, 83.1% corresponds to domestic origin assets, and the remaining 16.9% to foreign investment, according to the figures reported at the end of December 2017. Furthermore, the main investment goals for the diversification of the portfolio invested abroad are the US and Luxembourg, which respectively represented 35.4% and 12.1% of the total amount of foreign assets on the mentioned date.

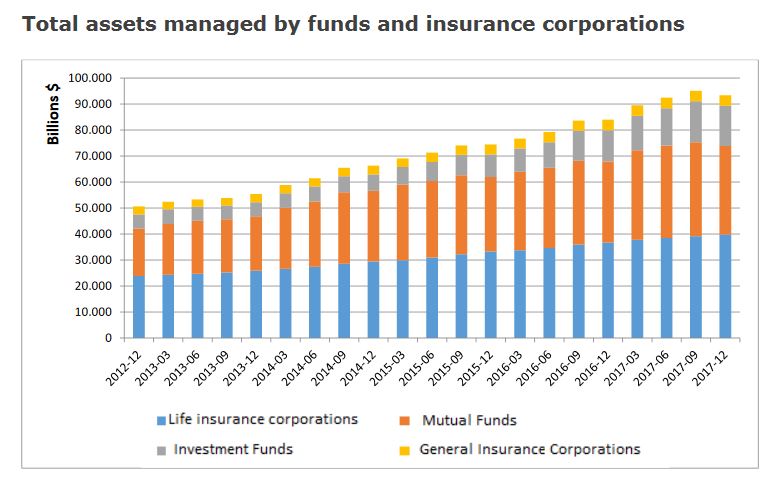

- Whereas the total assets managed by the funds registered a decrease of 4.8% compared to the end of September, the insurance corporations had a small increase of 1.7% in the same period. In addition, the total assets managed by insurance funds and corporations decreased 1.8% regarding the previous quarter, reaching US$151 billion.

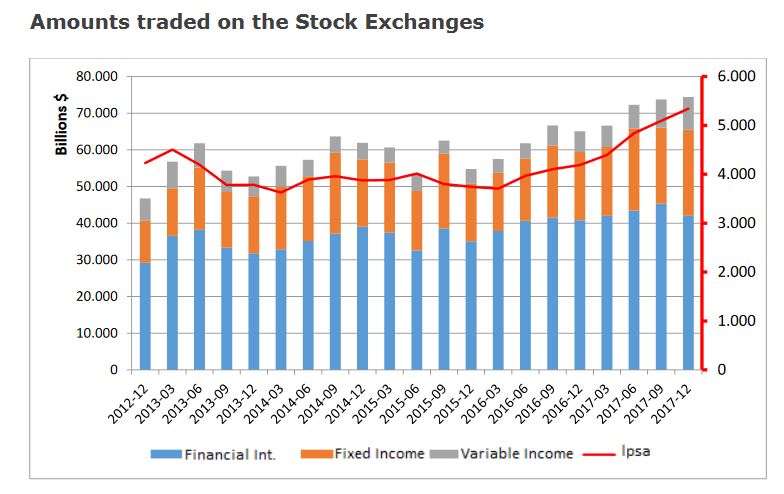

- The amount traded on the Stock Exchanges in 2017 increased to US$466 billion, which is the equivalent of an increase of 14.4% regarding 2016. These results are attributable to greater transactions in financial intermediation operations, fixed income, and variable income, which respectively increased 7.5%, 20%, and 51.6% compared to the previous period.

- While the insurance market had a direct premium, which increased to US$13 billion during 2017, and which represented a drop of 0.6% compared to what was registered during the same period in the previous year. Such drop is explained due to the increase in premiums obtained by general insurance corporations (+2.0%), in contrast to life insurance corporations (-1.7%).

Link to the Quarterly Statistical Report:

http://www.cmfchile.cl/portal/estadisticas/606/articles-24881_doc_pdf.pdf

Link to the files of the current report:

http://www.cmfchile.cl/portal/estadisticas/606/w3-propertyvalue-24708.html

Communication,Education,and Image Area-Financial Market

Commission - Contact: prensa@cmfchile.cl -562 2617 4034